Over the past 10 years the founders of European Space Ventures AG (ESV) have developed a proprietary research tools to inform its investment strategy, help merge and integrate assets, and identify what space investors are really looking for within commercial space and the opportunities it provides.

European Space Ventures Consulting Services

Space Sector Macro – Finding the Signal From the Noise

The space industry is built upon waves of innovation and shifting priorities. Funding to the sector, both private and public, is important but they can also distort the value of sub-verticals in the space industry; this raises questions such as: Why is one sector more invested than the other? Is increased innovation in a specific sector, and then activity in for example an orbit, an outlier or a precursor for an entire industry change?

ESV takes an independent approach to evaluating where New Space is going.

Europe currently offers change and opportunity like no other space market

A sovereign Europe must not only catch-up to but actually surpass the innovation and industrial prowess of the US, Russia and China if Europe desires to be competitive in the space race.

ESV measures the pace of local space innovation against international activities, and with one eye on policy (the diplomatic awareness of opportunities) we also examine what is possible and how investable it is.

For more information, see Space Fortress Europe Research.

Hidden Champions: Predicting Trajectories from Start-ups to SMEs and beyond

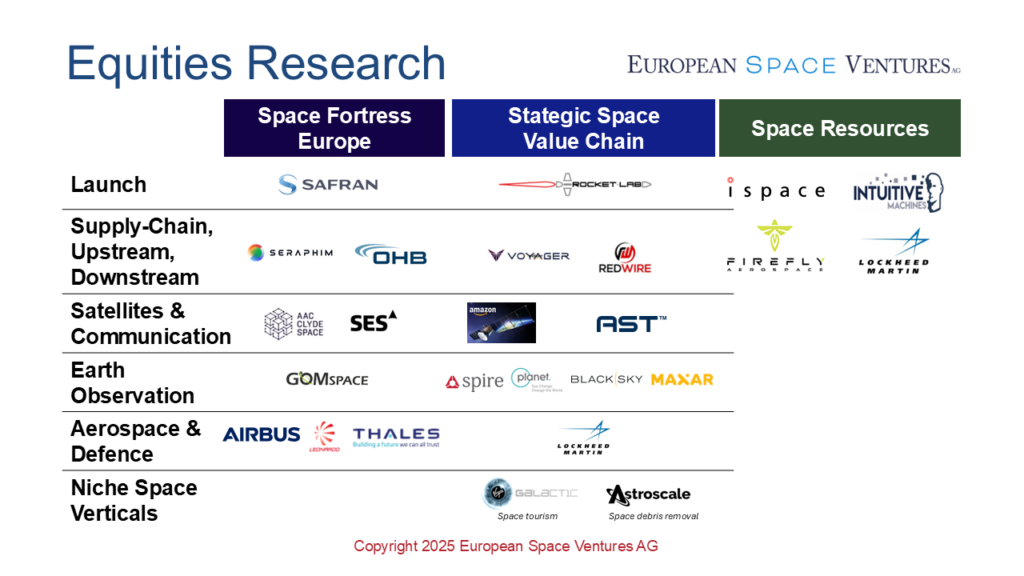

Actively scouting promising space ventures as investments in Europe is the core competence at ESV. Our strategic due diligence process, the Strategic Space Value Chain, is based upon more than 10 years experience reviewing start-ups, SMEs and larger companies within this sector. ESV’s activities are focussed on which emerging space companies (and there are many) will be in a position to leverage their technical expertise in a future and evolved space ecosystem This gives ESV the ability to research and project the space ecosystem, independent of current promising but passing trends, and focus on the fundamentals of an ever evolving space industry.

Case Study: Dot-Com Boom vs LEO Connectivity Boom. What Next?

Global connectivity is reliant on layers of hardware, much of it now in Low Earth Orbit (LEO), and it has evolved over many decades. The recent wave of space investment in conjunction with a massive investment in digital infrastructure (developing an investment bubble to rival the Dot-Com era), has created an LEO Connectivity Boom (as a distinct space vertical). The consumer wants connectivity and uninterrupted (stream media when out of town), industry understands the value (Internet of Things, remote operations), and experience shows that space entrepreneurs flock to an engineering challenge and opportunity when the business model receives funding. The last connectivity precedent was the Dot-com-Boom which funded the fixed-line global internet infrastructure that eventually gave way to the digital revolution. The Dot-Com Boom did have a financial bust, but the internet architecture that it built remained as a valuable asset.

In contrast, a LEO Connectivity Boom entails thousands of satellites in LEO, and a high rate of loss of satellites. If the LEO Boom becomes a financial bust, the assets cannot remain in an unstable orbit indefinitely; the best case are fiery re-entries, the worst case scenario is lack of attention to orbiting assets that trigger a space debris incident.

If you want to know more about investment opportunities in New Space then contact ESV.

ESV New Space Workshops

ESV has developed a series of modular workshops for clients who want to develop an investment strategy for the space sector. Duration can be 2, 4 or 6 hours, and delivered online, in-person, or hybrid.

Current Space Consulting Themes